So recently, alongside all the other mail I usually receive, I get this solicitation to borrow up to $2,500 via a service called Elastic. Often I just rip these into a few pieces and toss into the trash along with all the other garbage advertisements I get. Sometimes I read through the terms to see just how bad they are.

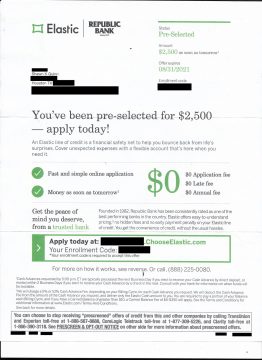

In the case of Elastic, not only are the terms terrible, Republic Bank is not even calling the charges “interest”, but instead uses the terms “cash advance fee” and “carried balance fee”. Here’s the actual advertisement (with anything which could possibly be used as an identifier blacked out, except for my name and my city which are honestly not secret to anyone who has read this blog for any length of time):

That big green “$0” should be a huge red flag. Technically, the lack of an application fee, annual fee, or late fees may be true. If you read the rest of it, you’ll figure out quickly that if you were to take this offer, this is the last lender you would want to be late in paying as what happens becomes downright odious.

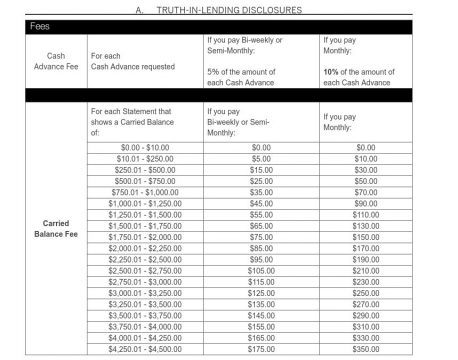

The printed materials don’t even tell you how much the carried balance fee is; for that you have to go onto the website and do some digging. You get this chart, which mentions the dollar amounts but doesn’t tell you what they would be as an APR:

To figure out the APR, you need a calculator or a spreadsheet, and a lot of patience. The carried balance fees by themselves represent an APR of anywhere from 48% to realistically topping out at around 100%. The cash advance fee would represent 60% or 120% APR by itself for a loan carried for an entire year, higher for shorter terms (as it is the same amount regardless of how long you borrow the money for). Even in the absolute best case, they are high enough to make 36% APR credit cards look like a bargain (even after factoring in the usually-obscene annual fee to the APR).

I get that payday loans are not cheap, partly due to the high-risk clientèle. But, it is an insult to the intelligence of even an average person to not refer to fees to borrow money as interest, and even to come right out and say “Your Elastic Account does not have an interest rate like other traditional credit products.” That’s an outright lie: it does, and it’s much higher.

Perhaps more insidious than that, though, is the side-step around the Truth In Lending Act requirement to disclose an APR, done by simply not mentioning rates at all for the interest (“carried balance fee” in Republic Bank newspeak). I call this a loophole. Granted, it’s probably not one foreseen at the time TILA was enacted into law (nor were predatory payday lenders in the quantity and type that we see today), but nevertheless a large loophole and one that needs to be closed.

What’s the point of TILA if it allows the most unscrupulous lenders to side-step disclosure of the interest rate as an APR? Laws like this were enacted to protect the borrower by making loan terms easier to understand.

Finally, getting back to that bit about late fees. There is, most definitely, a cost to missing payments or paying late on this loan. The minimum payment will include any past due balance tacked on. If your usual minimum payment is, say, $125, the next payment after you miss will be easily $250 if not more. Technically, like most other lenders, Republic Bank can ask for the entire balance immediately after you miss one payment. They hardly ever do this, of course, but it’s an option nonetheless. Even if you are $1 short of the minimum, it will count as a late payment for credit reporting purposes. And yes, it’s to Republic Bank’s advantage to report as much negative data as possible; this helps keep decent, non-predatory credit products out of reach of their borrowers.